Introduction

The United States is witnessing a substantial demographic shift as its 73 million baby boomers gracefully age, resulting in a surge in revenues for specialized industries tailored to meet the unique needs of this aging population. According to projections from the U.S. Census Bureau, by the year 2050, the U.S. population ages 65 and over will reach a staggering 83.9 million, nearly double the figure recorded in 2012. The baby boomer cohort, who commenced turning 65 in 2011, stands as the primary driver behind the nation’s expanding older demographic.

Financial Growth in Senior Care Industries

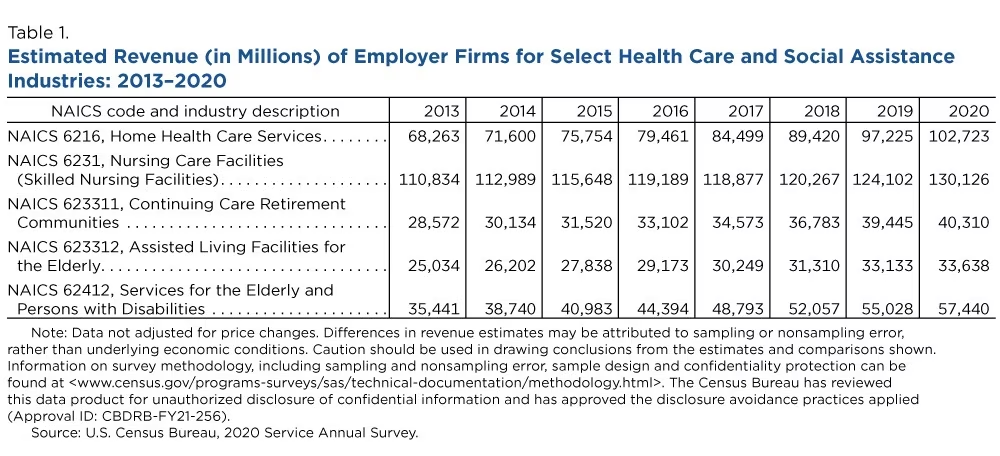

The Service Annual Survey (SAS) offers a comprehensive view of the revenue landscape within select service industries catering to the elderly, showcasing notable increases from 2013 to 2020. Noteworthy among these are five key healthcare sectors providing essential services for the aging population (set out in the list and table below):

- Continuing Care Retirement Communities: Comprising establishments offering residential and personal care services with on-site nursing care facilities, these communities cater to individuals who may require assistance in daily living or choose not to live independently. The range of services includes meals, housekeeping, social activities, and personal care. This industry has witnessed significant financial growth in response to the aging population’s evolving needs.

- Assisted Living Facilities for the Elderly: These establishments, providing residential and personal care services without on-site nursing care, have experienced a remarkable 34.4% increase in revenue from 2013 to 2020. The services offered typically include room and board, supervision, and assistance in daily living, addressing the needs of those who cannot fully care for themselves.

- Services for the Elderly and Persons with Disabilities: Focusing on nonresidential social assistance services, this sector aims to enhance the quality of life for the elderly and individuals with intellectual, developmental, or physical disabilities. The range of services encompasses day care, nonmedical home care, social activities, group support, and companionship.

- Home Health Care Services: This industry, primarily offering skilled nursing services at home, has witnessed impressive financial growth, boasting a 50.5% increase in revenue from 2013 to 2020. The services provided include personal care, physical therapy, medical equipment, and 24-hour home care, among others.

- Nursing Care Facilities (Skilled Nursing Facilities): These establishments provide inpatient nursing and rehabilitative services for an extended period, with a permanent core staff of registered or licensed practical nurses. While having the highest revenues among the five industries, nursing care facilities experienced slower revenue growth, with a 17.4% increase from 2013 to 2020.

Revenue Growth Insights

The revenue growth observed across these selected industries signifies evolving care choices made by the nation’s seniors and their families. Notably, Assisted Living Facilities for the Elderly and Home Health Care Services demonstrated substantial increases, shedding light on the changing preferences and demands in senior care. As the aging population continues to grow, these insights become crucial for adapting and enhancing the services provided by the senior care industry to meet the diverse needs of this demographic.

Source: https://www.census.gov/library/stories/2022/08/revenues-for-home-care-elderly-services-increase.html